U nadmetanju između vozila na vodonik i električnih, pobeđuju ova druga, vođena značajnim napretkom u tehnologiji, infrastrukturi i vladinoj podršci.

Početkom 2000, američki predsednik Džordž Buš Mlađi najavljivao je vodonik kao gorivo koje će revolucionarno izmeniti automobilsku industriju i konačno pomeriti Sjedinjene Američke Države ka energetskoj nezavisnosti. U svom obraćanju o stanju nacije 2003. godine, Buš je najavio investiciju od 1,2 milijarde dolara u tehnologiju vodoničnog goriva, slavodobitno izjavljujući: „Prvi automobil koje će voziti dete koje je rođeno danas bi mogao da se kreće na vodonik i da ne zagađuje prirodno okruženje“. Vizija je bila hrabra, uticala je na rastuću ekološku svest i želju javnosti da se smanji oslanjanje na stranu uvezenu naftu. Optimizam tog doba bio je zarazan, sa velikim proizvođačima automobila i energetskim kompanijama koje su se okupljale iza ove predikcije da će budućnosti njihove industrije biti na vodonik.

Međutim, velike nade tog vremena su se susrele sa otrežnjujućom stvarnošću. Uprkos preko 2,5 milijardi dolara usmerenih od strane države i značajnim investicijama privatnog sektora, automobili na vodonik ostaju retkost na putevima. Sama proizvodnja vodoničnog goriva se pokazala kao skupa i energetski intenzivna, pri čemu se preko 95% vodonika još uvek proizvodi iz prirodnog gasa, procesa koji emituje značajne količine ugljen-dioksida. Pored toga, infrastruktura potrebna za podršku vozilima na vodonik, kao što su pumpe za ovo gorivo, je retka, sa samo oko 60 javnih vodoničnih stanica u SAD-u napravljenih od 2003. do 2023. godine, uglavnom koncentrisanih u državi Kaliforniji. Ovi navedeni izazovi su ozbiljno ograničili veću ekspanziju vozila na vodonik kroz prethodnih 20 godina.

Dok se automobili na vodonik bore da steknu kakvu takvu popularnost i primenu, prosečan građanin zainteresovan za ekološke inovacije bi mogao da se jednostavno zapita da li je još uvek moguće preokrenuti ovaj trend? Da li bi dalji tehnološki napredak i obnovljena ulaganja u ovu tehnologiju mogla da udahnu novu energiju ovim projektima i da unaprede tehnologiju upotrebe vodonika?

Sa tekućim istraživanjem efikasnijih i održivijih metoda proizvodnje vodonika, kao i potencijalom za napredak u tehnologiji gorivnih ćelija, neki stručnjaci tvrde da bi doba vodonika moglo ipak doći uskoro. S obzirom da električna vozila brzo postaju nosioci standarda zelenog transporta, ostaje pitanje da li vodonik može da prevaziđe svoje trenutne izazove ili će ostati igrač u svojoj niši na tržištu kojim sve više dominira električna energija. Iz tog razloga, važno je analizirati samu tehnologiju, koju konkurenciji u sferi ekoloških rešenja ima i da li vlade sa svojim programima i regulacijama mogu da prepoznaju vodonik kao rešenje nekada u budćnosti.

Tehnološke mogućnosti i prepreke

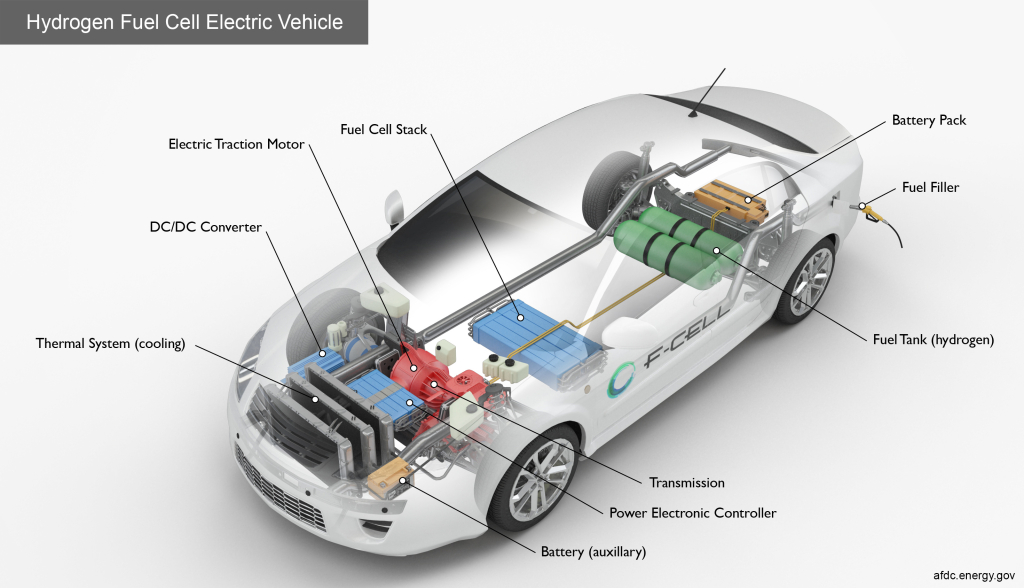

Vozila na vodonik, ili vozila sa vodoničnim gorivnim ćelijama (na engleskom skraćeno FCV), rade koristeći gorivnu ćeliju koja pretvara vodonični gas u električnu energiju. Proces uključuje propuštanje vodonika kroz gorivnu ćeliju gde on deluje u reakciji sa kiseonikom iz vazduha. Ova hemijska reakcija generiše električnu energiju, koja pokreće električni motor automobila, sa vodenom parom kao jedinim nusproizvodom, što ga čini alternativom bez štetnih emisija. Za razliku od akumulatorskih električnih vozila (poznatijih skraćeno i kao EV), koja skladište električnu energiju u baterijama, automobili na vodonik proizvode električnu energiju na komandu, pružajući prednost bržeg punjenja goriva slično klasičnim vozilima na benzin.

Međutim, širenje upotrebe automobila na vodonik suočava se sa nekoliko značajnih prepreka, posebno u poređenju sa drugim ekološki prihvatljivim alternativama kao što su električna vozila. Jedan od osnovnih izazova je proizvodnja i skladištenje vodonika. Većina vodonika danas se proizvodi kroz obradu prirodnog gasa, procesom koji emituje značajne količine CO2, negirajući u tom procesu neke od njegovih ekoloških prednosti. Pored toga, transport i skladištenje vodonika zahtevaju rezervoare pod visokim pritiskom i specijalizovanu infrastrukturu, što povećava složenost celog procesa širenja i cenu. Nedostatak široko rasprostranjene mreže za punjenje vodonikom je još jedna velika prepreka koja ograničava praktičnost automobila na vodonik za prosečnog potrošača, posebno u regionima gde je infrastruktura oskudna, a to je velika većina sveta.

Uprkos izazovima sa kojima se suočavaju automobili na vodonik, industrija polaže delom nade u koncept takozvanog „zelenog vodonika“ kao svoju priliku za revitalizaciju ovog izvora energije. Zeleni vodonik se proizvodi elektrolizom vode, koristeći obnovljive izvore energije poput vetra, sunca ili hidroenergije, što rezultira zaista gorivom sa nultom emisijom. Ovaj metod eliminiše emisije ugljenika povezane sa tradicionalnom proizvodnjom vodonika iz prirodnog gasa, rešavajući jednu od ključnih ekoloških kritika vodonika kao izvora goriva. Kako cena obnovljive energije nastavlja da pada i tehnologija elektrolize se poboljšava, zeleni vodonik bi mogao postati održivija opcija za pogon vozila. Industrija se delom nada i da zeleni vodonik ima potencijal izvan automobilske industrije, uključujući primene u teškoj industriji, vazduhoplovstvu i skladištenju energije, stvarajući šire tržište za vodonik i potencijalno smanjenje troškova kroz ekonomiju obima.

Međutim, široko rasprostranjena promema zelenog vodonika suočava se sa značajnim preprekama koje smanjuju njegov potencijal. Trenutni troškovi proizvodnje zelenog vodonika su i dalje mnogo veći od troškova vodonika dobijenog iz fosilnih goriva, što ga čini ekonomski nekonkurentnim bez značajnih subvencija ili regulatorne podrške države. Efikasnost elektrolize, iako se poboljšava, ostaje relativno niska, što znači da su potrebne velike količine obnovljive energije za proizvodnju malih količina vodonika. Ova neefikasnost izaziva zabrinutost za mogugućnost ekonomije obima zelenog vodonika, posebno kada se imaju u vidu ogromne količine obnovljive energije potrebne za napajanje drugih sektora kao što su električne mreže i industrijski procesi. Štaviše, čak i ako proizvodnja zelenog vodonika postane izvodljivija, postojeći izazovi infrastrukture za skladištenje, transport i punjenje goriva ostaju veliki, a naročito u odnosu na drugu ekološku konkurenciju poput električnih vozila.

Konkurencija vodoniku

Za razliku od vodonika, električna vozila su napravila izuzetan napredak u prevazilaženju sličnih izazova. Tokom protekle decenije, cena litijum-jonskih baterija, koja napajaju električnih vozila, opala je za skoro 89%. Ta cena je pala sa preko 1 100 dolara po kilovat-satu u 2010. na oko 132 dolara po kilovat-satu u 2023. godini. To je učinilo električna vozila pristupačnijim i dostupnijim široj potrošačkoj grupi od vozila na vodonik.

Osim toga, globalna mreža stanica za punjenje električnih vozila nastavlja brzo da raste, sa hiljadama novih stanica koje se instaliraju svake godine. Štaviše, svetska mreža stanica za punjenje električnih vozila se brzo proširila, sa preko 2 miliona javnih punjača dostupnih širom sveta pred kraj 2023. godine, u poređenju sa samo nekoliko stotina stanica za punjenje vodonikom. Ova obimna infrastruktura učinila je upotrebu električnih vozila sve pogodnijim, što je dodatno preokrenulo tas na vagi u korist električne energije u odnosu na vodonik u prethodnih desetak godina.

Električna vozila takođe imaju koristi od napretka u integraciji obnovljive energije, čineći sve više mogućim punjenje vozila korišćenjem čistih izvora energije kao što su solarna energija ili energija vetra. Ovi faktori su zato pozicionirali električna vozila kao vodeću alternativu tradicionalnim vozilima na fosilna goriva, ostavljajući automobile na vodonik da se bore sa značajnim zaostatkom.

Tržišna uspešnost različitih tipova ekoloških vozila bila je zato i veoma različita u merljivim ciframa. Do 2023. godine, prodaja električnih vozila je premašila 10 miliona godišnje (sa hibridima preko 40 000 000 njih na ulicama), što predstavlja približno 14% globalnog tržišta automobila. To je značajan porast sa samo 2,5% u 2019. Nasuprot tome, prodaja automobila na vodonik je ostala stagnantna sa manje od 50 000 prodatih jedinica širom sveta od njihovog uvođenja. Samo u Švedskoj i samo 2022. prodato je 140 000 novih električnih vozila i hibrida, što je više nego duplo više od celokupnog postojećeg voznog parka na vodonik u svetu. U tom smislu, sa svakom godinom električna vozila prave sve veću razliku u odnosu na svoju drugu ekološku konkurenciju poput vozila na natrijumske baterije ili vodonik, a delom su za to zaslužne i politike vlada.

Vlade i programi

Vlade širom sveta istorijski su dale prednost električnim vozilima u odnosu na automobile na vodonik u svojim javnim politikama uglavnom zbog bržih i opipljivijih prednosti koje ova vozila nude u smislu smanjenja emisija. Jedan od ključnih razloga za ovu preferenciju je spomenuto smanjenje troškova tehnologije baterija, što je učinilo električna vozila ekonomski isplativijim, jer kada su početkom 2010-ih cene baterija počele značajno da padaju, vlade su videle priliku da podrže tehnologiju koja se brzo približava tržišnoj konkurentnosti. Na primer, 2010. godine, američka vlada je pokrenula investiciju od 2,4 milijarde dolara u proizvodnju baterija i električnih vozila prema „Američkom zakonu o oporavku i reinvestiranju“, sa ciljem da se ubrza usvajanje električnih vozila. Slične politike su sprovedene u Evropi i Kini, gde su vlade obezbedile velikodušne subvencije za kupce električnih vozila i uložile velika sredstva u infrastrukturu za punjenje.

Ključna prekretnica nastupila je sredinom 2010-ih kada su globalni klimatski sporazumi, kao što je Pariski sporazum iz 2015. godine, pojačali fokus na trenutna i skalabilna rešenja za smanjenje emisija ugljenika. Električna vozila sa svojom rastućom popularnošću i unapređenjem tehnologije, viđena su kao najizvodljivija opcija za ispunjavanje ovih ambicioznih ciljeva brže u odnosu na konkurenciju. Evropska unija je, na primer, postavila stroge standarde za emisije CO2 koji su efikasno podstakli proizvođače automobila da ubrzaju svoj razvoj električnih vozila, što je dovelo do porasta proizvodnje i prodaje. Nasuprot tome, automobili na vodonik, koji su se i tada suočavali sa značajnim tehnološkim i infrastrukturnim izazovima, smatrani su možda rešenjem u dalekoj budućnosti, ali ne u neposrednoj. Shodno tome, vlade su nastavile da daju prioritet električnim vozilima u svojim ekološkim politikama, pružajući dalje podsticaje kao što su poreske olakšice, grantovi i ulaganja u mreže za punjenje.

Nemačka, američka i kineska vlada naravno još uvek nude velike subvencije za upotrebu pomenutog “zelenog vodonika” koji nastaje kroz elektrolizu, jer ne žele da u potpunosti isključe ovu energiju. Nove subvencije za ovaj energetski izvor definisane su i u novom programu administracije Džoa Bajdena koji je promovisan nakon COP28 svetskog samita o klimi. Međutim, u državama gde su ambiciozni ekološki planovi već izglasani, prilikom iznenadnih smanjenja obima dostupnih sredstava, od ekološke agende finansiranje projekata sa vodonikom bilo je prvo na spisku za seču.

Najbolji primer za to je Nemačka, gde je nakon odluke ustavnog suda o neustavnoj alokaciji javnih sredstava iz vremena COVID-19 pandemije vladi naloženo da smanji javnu potrošnju. Od svih ekoloških mera koje su bile predmet redukovanja, jedna od prvih bio je cilj da se do 2030. obezbedi finansiranje podizanja 10 GW kapaciteta proizvodnje zelenog vodonika i uvećavanja uvoza ovog energenta. U istoj državi je prethodne godine zabeležen pad broja registracija vozila na ovaj pogon za 70%, odnosno sa 835 vozila iz 2022. na samo 263 u 2023.

Udruženje nemačkih poreskih obveznika „Bund der Steuerzahler“ je zbog toga u septembru 2023. pozvalo na ukidanje subvencija za ovaj vid vozila i stanice za dopunu vodonika, procenjujući da je za njih od 2007. potrošeno najmanje 450 miliona evra, bez uračunatih sredstva EU, što je bila velika potrošnja u odnosu na broj ovih vozila na putevima. Vodonik je izgubio i kada se radi o nemačkom javnom prevozu i železnicama u odnosu na baterije i elektrifikaciju.

Kineska vlada je takođe sprovela agresivnu politiku, uključujući značajne subvencije za proizvođače i kupce električnih vozila već godinama, i postavila ambiciozne ciljeve da 25% svih prodaja automobila bude električni do 2025. godine, dok je vozila na vodonik uglavnom zanemarila. U tom smislu, ovaj disparitet nije samo pitanje zapadnih država, već globalni trend u politikama vlada.

Mogućnosti za budućnost

U nadmetanju između automobila na vodonik i električnih vozila definitivno su pobedila ova druga, vođena značajnim napretkom u tehnologiji, infrastrukturi i vladinoj podršci. Dok su automobili na vodonik obećavali revolucionarnu alternativu čiste energije početkom 2000-ih, realnost visokih troškova, infrastrukturnih izazova i ograničenog prodora na tržište držali su ih po strani. S druge strane, električna vozila su imala koristi od brzog pada troškova baterija, širokih globalnih mreža za punjenje i značajnih državnih subvencija, što ih čini praktičnijom i široko prihvaćenom zelenom tehnologijom gotovo konsenzulano u svetu.

Kao što je spomenuto, vladine politike su odigrale ključnu ulogu u ovom ishodu. Od ranih 2000-ih, mnoge vlade, posebno u SAD-u, Evropi i Kini, davale su prednost električnim vozilima zbog njihovog neposrednog potencijala da smanje emisije ugljenika i poboljšaju energetsku efikasnost. Politike kao što su poreske olakšice, direktne subvencije i ulaganja u infrastrukturu za punjenje učinile su električna vozila pristupačnijim i privlačnijim za potrošače. Lobi za vozila na vodonični pogon nije bio dovoljno jak i ubedljiv u odnosu na zakonodavce, iako su vlade opredeljivale određena sredstva za razvoj tehnologije vodonika i još uvek to rade.

Gledajući unapred, iako vodonik još uvek može da igra ulogu u budućnosti transporta, posebno kroz razvoj zelenog vodonika, ogromna podrška za električna vozila i odluke industrije sugerišu da će oni nastaviti da dominiraju tržištem. Kombinacija tehnološkog napretka, povoljosti na tržištu i podrške vlade stvorila je zamah za električna voila koji će biti teško preokrenuti. Automobili na vodonik, uprkos svom potencijalu, verovatno će ostati tehnologija u niši, osim ako značajna otkrića dramatično ne promene trenutni odnos snaga.

Leave a Comment

Your email address will not be published. Required fields are marked with *